Car title loans, despite their appeal as quick cash solutions, are heavily regulated by state laws that vary significantly. These regulations control interest rates, loan amounts, repayment periods, and default resolution methods, aiming to protect borrowers from predatory lending practices. Understanding these state-specific restrictions, including Annual Percentage Rate (APR) caps and borrower assessment requirements, is crucial for making informed decisions and ensuring compliance with local consumer protection laws.

Understanding state law is crucial when considering a car title loan, as regulations vary significantly across the US. This article explores how state laws impact loan terms and conditions, with a focus on protecting borrowers. We delve into the diverse car title loan regulations, highlighting the importance of state restrictions in ensuring fair practices and preventing predatory lending. By examining these legal aspects, borrowers can make informed decisions, navigating the complexities of car title loans with confidence.

- Car Title Loan Regulations Across Different States

- The Impact of State Laws on Loan Terms and Conditions

- Protecting Borrowers: How State Law Ensures Fair Practices in Car Title Loans

Car Title Loan Regulations Across Different States

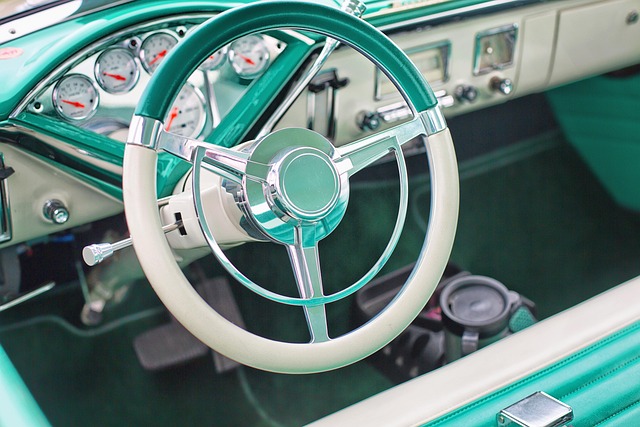

Car title loans, despite their appeal as a quick financial fix, are subject to significant state-level regulations. These restrictions vary widely across different states, influencing everything from interest rates and loan terms to requirements for obtaining and retaining a car title during the title loan process. For instance, some states have strict limits on the maximum loan amount, while others permit higher loans with shorter repayment periods.

Moreover, state laws dictate the procedures for loan approval and title transfer, often mandating thorough vehicle inspections, transparent disclosure of terms, and specific methods for resolving defaults or repossessions. These variations underscore the importance of understanding one’s state’s regulations before considering a car title loan. Such knowledge ensures compliance with local rules and can help borrowers avoid exploitative practices, making informed decisions about this high-stakes financial instrument.

The Impact of State Laws on Loan Terms and Conditions

The terms and conditions of car title loans can vary significantly from state to state due to differing legal frameworks and consumer protection regulations. Each state has its own set of restrictions and guidelines regarding these types of short-term, high-interest loans, impacting factors such as maximum interest rates, loan amounts, and repayment periods. For instance, some states may impose limits on the number of rollovers allowed, while others restrict the practice altogether. These laws are designed to protect consumers from predatory lending practices, ensuring they have a clear understanding of the loan’s terms and conditions before agreeing to them.

State regulations also influence how the security for these loans is handled, often centered around the title transfer process. Laws govern what information must be disclosed during the application phase, including details about the vehicle’s valuation, which is crucial for determining loan eligibility. Additionally, state laws dictate the procedures for repossession in case of default, ensuring that lenders adhere to fair and transparent practices when dealing with borrowers’ collateral.

Protecting Borrowers: How State Law Ensures Fair Practices in Car Title Loans

State laws play a pivotal role in protecting borrowers who opt for car title loans, ensuring that lenders adhere to fair and transparent practices. These regulations are designed to safeguard consumers from predatory lending behaviors, which are prevalent in the short-term loan industry. By implementing state restrictions on car title loan practices, borrowers can rest assured that they are not subjected to excessive interest rates or unfair terms.

For instance, many states have caps on the annual percentage rate (APR) for car title loans, preventing lenders from charging exorbitant fees. Additionally, some regulations mandate that lenders conduct a comprehensive assessment of the borrower’s ability to repay, ensuring that loan approval is based on their financial health rather than just the value of their vehicle. This approach promotes responsible lending and helps borrowers in Dallas (Dallas Title Loans) or those with bad credit (Bad Credit Loans) access funds without falling into a cycle of debt. Such state-level interventions contribute to a more equitable market, fostering trust among consumers seeking loan approval.

Understanding the car title loan state restrictions is crucial for both lenders and borrowers. These regulations, dictated by each state’s laws, significantly shape the terms and conditions of these loans, ensuring consumer protection and fair practices. By adhering to these guidelines, lenders can offer transparent and accessible financial solutions, helping borrowers navigate a potentially complex landscape. Ultimately, recognizing the importance of state law is key to fostering a trustworthy and equitable car title loan industry.