Car title loan state restrictions are laws protecting consumers from predatory lending, varying across states and influencing lender policies. Key regulations cover interest rates, loan amounts, repayment periods, and collection practices, with some states capping rates and emphasizing quick approvals for emergency aid while maintaining responsible lending standards. These restrictions significantly impact lender practices and interest rates, affecting credit access and borrowing costs differently in each state, balancing consumer protection with access to credit.

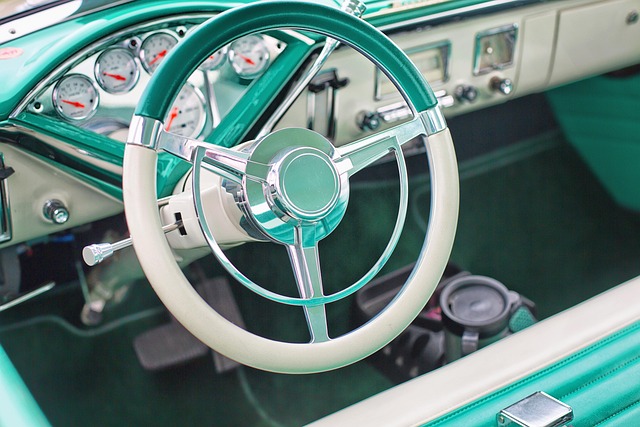

Car title loan state restrictions significantly shape lender policies, impacting access to credit and interest rates across the country. Each state’s unique regulations govern these short-term loans secured by a vehicle’s title, leading to varied practices among lenders. This article explores how these restrictions influence lending standards, consumer protection measures, and the overall landscape of car title loan services, providing insights into the intricate balance between access to credit and financial safeguards.

- Understanding State Regulations on Car Title Loans

- Impact on Lender Practices and Interest Rates

- Consumer Protection vs. Access to Credit

Understanding State Regulations on Car Title Loans

Car title loan state restrictions are laws and regulations implemented by individual states to govern and protect consumers from predatory lending practices. These restrictions vary widely across the country, shaping the policies and operations of lenders offering car title loans. Understanding these regulations is crucial for both borrowers and lenders as they directly impact access to financial assistance and loan terms.

State restrictions often cover interest rates, loan amounts, repayment periods, and collection practices. Some states have put caps on interest rates, ensuring borrowers do not fall into a cycle of high-interest debt. Others require direct deposit of loan proceeds, enhancing transparency and preventing fraudulent activities. Quick approval processes are also a focus, aiming to provide relief for borrowers in need of emergency financial assistance while maintaining responsible lending standards.

Impact on Lender Practices and Interest Rates

Car title loan state restrictions significantly shape lender practices and interest rates charged on these short-term loans. In states with stringent regulations, lenders often employ more conservative lending models to ensure compliance, leading to higher borrowing costs for borrowers. These restrictions may include limits on loan-to-value ratios, borrower income verification requirements, and collection practices, all of which contribute to a tighter credit environment. As a result, Fort Worth loans, like those in many regulated states, might offer quicker loan approval processes but with lower borrowing limits and competitive interest rates compared to less restricted markets.

Lenders in highly regulated areas often focus on mitigating risk, which can impact their willingness to lend and the terms they offer. Stringent regulations may drive up the cost of capital for lenders, prompting them to pass on these expenses to borrowers through higher interest rates. Conversely, states with fewer restrictions might see more aggressive lending practices and quicker funding, as lenders face less stringent compliance requirements. This disparity in state-level policies creates a diverse landscape for car title loan services, influencing both borrower access to credit and the overall cost of borrowing.

Consumer Protection vs. Access to Credit

The debate between consumer protection and access to credit is a delicate balance that is heavily influenced by state restrictions on car title loans. On one hand, strict regulations are implemented to safeguard consumers from predatory lending practices. These measures often include stringent loan requirements, such as caps on interest rates and terms, ensuring borrowers do not fall into cycles of debt. By keeping loan terms reasonable, borrowers can maintain their financial stability while keeping their vehicles, which is crucial for many in today’s world where transportation is essential.

However, excessive restrictions may inadvertently hinder access to credit for those who need it the most. Some lenders argue that certain state regulations create a labyrinthine process, making it difficult for them to offer these loans at competitive rates and terms. This can limit options for individuals with poor credit or limited financial resources, leaving them less likely to access the short-term funding they require to cover unexpected expenses or navigate a financial emergency. Balancing consumer protection and access is essential in ensuring fair lending practices without perpetuating systemic financial barriers.

Car title loan state restrictions significantly shape lender policies, balancing consumer protection with access to credit. As these regulations vary widely across states, lenders must adapt their practices and pricing strategies accordingly. Understanding these dynamics is crucial for both financial institutions looking to optimize their services and borrowers seeking the best terms in their state. By staying informed about evolving car title loan state restrictions, stakeholders can navigate this complex landscape effectively.