Car title loan state regulations vary by location, dictating terms like minimum vehicle value, loan-to-value ratios, and online application processes. These rules aim to protect borrowers from predatory lending practices, ensuring fair access to vehicle-backed loans. Lenders must comply with strict guidelines, including clear communication of terms and proper documentation, which can increase costs but enhance transparency. Understanding these restrictions is vital for both lenders and borrowers navigating car title loan options.

State regulations play a pivotal role in defining the collateral use for car title loans, impacting both lenders and borrowers. With varying legal landscapes across states, understanding these rules is crucial for navigating this form of secured lending. This article delves into the intricacies of state-mandated restrictions on car title loan collateral, exploring how they shape the practices of lenders while offering borrowers essential protections. By examining these regulations, we gain insight into the dynamic interplay between access to credit and consumer safeguard measures.

- Understanding State Regulations on Car Title Loan Collateral

- The Impact of These Rules on Lenders and Borrowers

- Navigating the Legal Landscape for Car Title Loan Collateral Use

Understanding State Regulations on Car Title Loan Collateral

State regulations play a pivotal role in defining the collateral requirements for car title loans, ensuring consumer protection and fair lending practices. These rules vary across different states, shaping how lenders can utilize vehicle titles as security for loans. Understanding these state restrictions is essential for borrowers seeking automotive financing, as it directly impacts the loan approval process and accessibility.

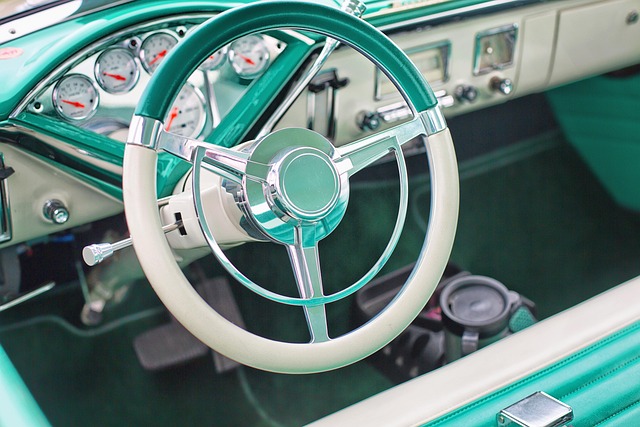

In many jurisdictions, including Houston Title Loans, lenders must adhere to stringent guidelines regarding the use of car titles as collateral. These regulations may dictate the minimum value of the vehicle required to secure a loan, set limits on loan-to-value ratios, and specify the types of vehicles eligible for title lending. Additionally, some states enforce restrictions on online application processes, ensuring borrowers undergo proper verification before securing a loan against their vehicle titles. Such measures aim to safeguard consumers from predatory lending practices while providing them with accessible financial options when needed.

The Impact of These Rules on Lenders and Borrowers

State regulations significantly shape the landscape for car title loans, impacting both lenders and borrowers alike. These rules govern how lenders can utilize vehicle titles as collateral, ensuring a secure lending environment while also offering borrowers protection from predatory practices. Lenders must adhere to specific guidelines regarding loan-to-value ratios, interest rates, and repayment terms, which affect their business model and ability to offer competitive rates. Borrowers, on the other hand, benefit from these restrictions as they limit the potential for excessive borrowing and ensure fair lending practices.

For lenders, compliance with car title loan state restrictions may involve complex processes, including thorough borrower assessments, clear communication of terms, and proper documentation. They must assess a borrower’s ability to repay, taking into account factors like income and existing debt, which can influence loan eligibility. While these regulations might increase operational costs for lenders, they also foster transparency and accountability, promoting a more stable lending market. For borrowers seeking vehicle-backed loans, understanding these rules is key to navigating the process effectively and ensuring they secure favorable terms, including options for loan refinancing or title transfer if needed.

Navigating the Legal Landscape for Car Title Loan Collateral Use

Navigating the legal landscape surrounding car title loan collateral use varies greatly from state to state. Each jurisdiction has its own set of regulations that dictate how lenders can utilize a borrower’s vehicle as security for a loan. These restrictions, often referred to as car title loan state restrictions, are designed to protect consumers by ensuring fair lending practices and preventing predatory lending schemes.

Understanding these regulations is crucial when considering a car title loan, especially for those relying on emergency funding. Key aspects include loan terms, interest rates, and the specific circumstances under which the vehicle can be repossessed. For instance, some states mandate direct deposit of loan proceeds into the borrower’s bank account, promoting transparency and immediate access to emergency funding. Others have stricter requirements regarding the collateral process, reflecting a balanced approach between providing necessary financial assistance and preserving consumer rights.

State regulations significantly shape the collateral usage in car title loans, impacting both lenders and borrowers. By understanding these rules, individuals can navigate the legal landscape more effectively. These restrictions, known as car title loan state restrictions, ensure consumer protection while providing a framework for accessible lending practices. Awareness of these regulations is crucial for all parties involved to avoid legal pitfalls and foster fair borrowing experiences.