Before securing a car title loan, borrowers must understand state-specific regulations, which protect against predatory lending practices and ensure borrower rights. These rules vary across U.S. states, impacting interest rates, repayment terms, maximum loan amounts, and collateral requirements. Online applications are available but must align with local laws. Verifying state guidelines on loan terms, repayment schedules, and collection practices empowers borrowers to make informed decisions, maintain vehicle ownership, and manage debt effectively.

Understanding your state’s title laws is crucial before taking out a car title loan. These regulations protect borrowers and can vary widely from one state to another. This article guides you through the key aspects of car title loan state restrictions, empowering you with knowledge about your rights and obligations. By navigating these legal intricacies, you can protect yourself and make informed decisions regarding short-term lending options.

- Understanding Car Title Loan State Restrictions

- Your Rights as a Borrower: What to Expect

- Navigating the Legal Aspects: Protecting Yourself

Understanding Car Title Loan State Restrictions

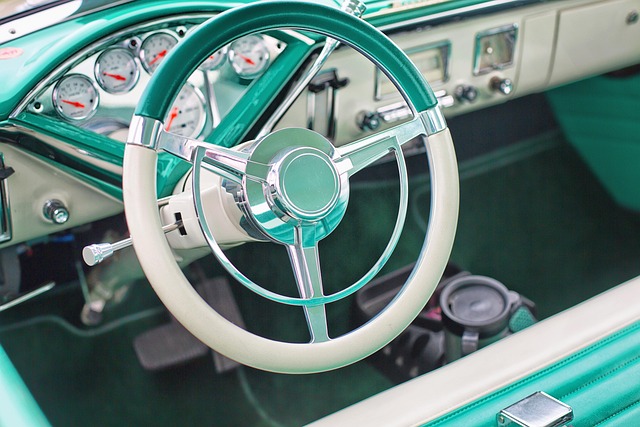

When considering a car title loan, it’s crucial to understand that regulations vary significantly from state to state in the U.S. These car title loan state restrictions are designed to protect borrowers by setting limits on interest rates, repayment terms, and lender practices. Some states have stricter rules than others, impacting factors like maximum loan amounts and whether a borrower can use their vehicle’s equity for collateral.

Knowing these restrictions is vital when exploring options for debt consolidation or loan extension. Each state’s laws will dictate the availability of online applications and digital lending platforms, which may offer more flexible terms but also require borrowers to remain informed about their rights and protections under local legislation.

Your Rights as a Borrower: What to Expect

As a borrower considering a car title loan, it’s crucial to understand your rights and what state laws dictate this process. Every state has its own set of rules when it comes to car title loans, so knowing these restrictions is essential before you commit. These regulations are in place to protect borrowers from predatory lending practices, ensuring fair terms and conditions.

Your rights encompass several key aspects. Lenders must disclose all loan requirements clearly, including interest rates, fees, and the potential consequences of missing payments. You have the right to keep your vehicle as collateral while repaying the loan, and lenders cannot seize it without due process. Additionally, most states have restrictions on same-day funding for car title loans, ensuring borrowers have time to understand the terms before finalizing any agreement.

Navigating the Legal Aspects: Protecting Yourself

Navigating the legal aspects of car title loans is crucial to protecting yourself and ensuring a smooth borrowing experience. Each state has its own set of restrictions and regulations when it comes to these types of loans, which are secured by your vehicle’s title. Understanding these laws can help borrowers avoid unfair practices and high-interest rates. For instance, some states have strict guidelines on interest rate caps, while others may limit the number of rollovers or extensions allowed, effectively reducing the overall cost of borrowing.

Before taking out a car title loan, it’s essential to verify your state’s rules regarding loan terms, repayment schedules, and collection practices. These regulations are designed to safeguard borrowers’ rights and prevent predatory lending. Additionally, knowing your state’s laws can help you leverage options like debt consolidation or negotiate better terms if you find yourself struggling with repayments. With the right knowledge, borrowers can make informed decisions, ensuring they maintain control over their vehicle ownership while managing their debt effectively.

When considering a car title loan, understanding your state’s specific laws is paramount. By familiarizing yourself with the car title loan state restrictions, your rights as a borrower, and navigating the legal aspects involved, you can make informed decisions to protect yourself from potential pitfalls. Remember, knowledge is power when it comes to financial transactions.