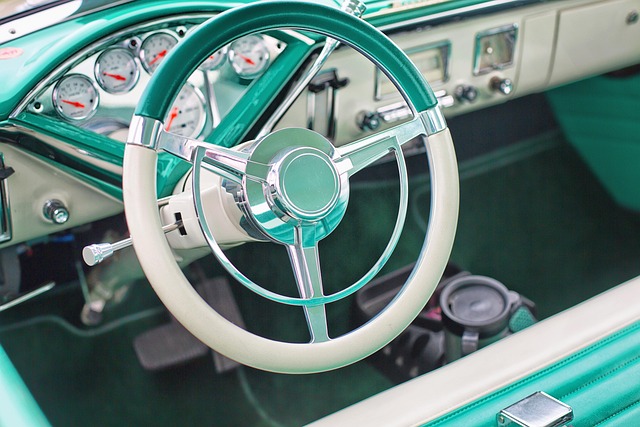

Car title loans are subject to diverse state regulations across the US, with each state setting its own rules regarding interest rates, fees, repayment terms, and more. These restrictions aim to protect both lenders and borrowers, ensuring fair lending practices and consumer rights. Understanding these state-level car title loan restrictions is vital for consumers and lenders, as they significantly influence loan approval processes and borrower decision-making, with some states offering more protective measures against predatory lending than others.

“State-level rules significantly shape the car title loan industry, impacting approval processes and consumer protection. With each U.S. state possessing its own regulatory framework for financial lending, car title loan regulations vary widely, affecting eligibility criteria and access to credit. This article explores how state restrictions, driven by factors like debt burdens and fraud prevention, influence these loans. We delve into the balance between facilitating lending and safeguarding consumers, analyzing regional variations that underscore the diverse landscape of car title loan state restrictions.”

- Understanding Car Title Loan Regulations at the State Level

- – Overview of state-level governance in financial lending

- – Key factors states consider when setting car title loan rules

Understanding Car Title Loan Regulations at the State Level

Car title loans, like any financial product, are subject to regulations that vary from state to state. These rules play a pivotal role in protecting consumers and ensuring fair lending practices in the car title loan industry. Each state has its own set of restrictions and guidelines that lenders must adhere to before offering such loans. This includes requirements for interest rates, fees, repayment terms, and more. Understanding these state-level regulations is crucial for both borrowers and lenders as it directly impacts loan approval processes.

State restrictions on car title loans are designed to safeguard the vehicle ownership rights of borrowers. They aim to prevent lenders from taking undue advantage of individuals in desperate financial situations. With quick approval often being a selling point for such loans, states have implemented measures to ensure that borrowers fully comprehend the terms and conditions before pledging their vehicles as collateral. This includes transparent disclosure of fees, interest rates, and potential consequences of default, making it easier for consumers to make informed decisions regarding loan repayment.

– Overview of state-level governance in financial lending

The financial lending landscape is intricately woven with state-level governance, where each US state has its own set of rules and regulations governing various aspects of lending practices, including car title loans. These state restrictions play a pivotal role in ensuring consumer protection and maintaining fairness within the lending industry. Every state has the authority to set guidelines for interest rates, loan terms, fees, and collection practices, creating a diverse spectrum of regulations that can significantly impact the car title loan process.

Understanding these state-level nuances is essential for lenders and borrowers alike, as it influences the entire title loan process, from initial application to final repayment. While some states have adopted more lenient approaches, allowing for quicker approvals and flexible terms, others maintain stringent regulations to safeguard consumers from predatory lending practices. This variation in rules underscores the need for borrowers to be aware of their rights and responsibilities when pursuing a car title loan while highlighting the complexity of navigating this type of financing across different jurisdictions.

– Key factors states consider when setting car title loan rules

When states enact rules for car title loans, several key factors come into play. These regulations are designed to protect consumers from predatory lending practices and ensure fair access to short-term financing secured by a vehicle. Primary considerations include setting maximum interest rates, defining the terms of loan repayment, and establishing requirements for lenders’ licensing and operations within the state. Many states also mandate transparent disclosure of loan terms, including fees and potential penalties for early repayment or default.

Furthermore, car title loan state restrictions often take into account the unique types of vehicles that can be used as collateral, such as cars, motorcycles, and even semi-truck loans. Some states may have specific rules regarding vehicle age, condition, and ownership to ensure the security of the collateralized loans. Additionally, while no credit check loans might sound appealing, states often require lenders to conduct at least a minimal level of credit verification to assess borrowers’ financial health and ensure they can repay the loan without falling into debt traps.

State-level regulations play a pivotal role in shaping the car title loan industry, ensuring consumer protection and fair lending practices. Each state’s unique approach to car title loan rules reflects its specific financial landscape and priorities. By understanding these restrictions, borrowers can make informed decisions and lenders can navigate this regulated environment effectively. This scrutiny is essential to prevent predatory lending, promote transparency, and safeguard vulnerable consumers, ultimately fostering a more robust and trustworthy car title loan market.